Support

Mobile Trading App

PC Trading App

Web Trading Platform

Download

Blogs About Trading

Technical Analysis: XAUUSD

06.08.2024

XAUUSD plummeted by more than 1%

On Monday, XAUUSD fell sharply from a high level. It decreased by around US$100 for some time. It ended down 1.33% at US$2409.32 per ounce.

US ISM non-manufacturing PMI exceeded expectations in July

US ISM Non-Manufacturing PMI (July) increased from 48.8 to 51.4 Vs. 51 (forecast), according to the data from the Institute for Supply Management.

Gold ETF holdings decreased

As of the 5th August, gold ETF holdings reached 844.90 tons, down 0.57 tons from the previous trading day, according to the world’s largest Gold ETF——SPDR Gold Trust.

Technically speaking, the bearish market trend prevailed in the short term

the Chart of the Day

On the chart of the day, XAUUSD fell sharply yesterday. The bearish market trend prevailed in the short term. In terms of technical indicators, MACD went downwards after death cross occurred, showing XAUUSD will fall further. Investors should focus on whether XAUUSD will break through the support at 2353. It will decline further with potential support at 2318 if it breaks below 2353.

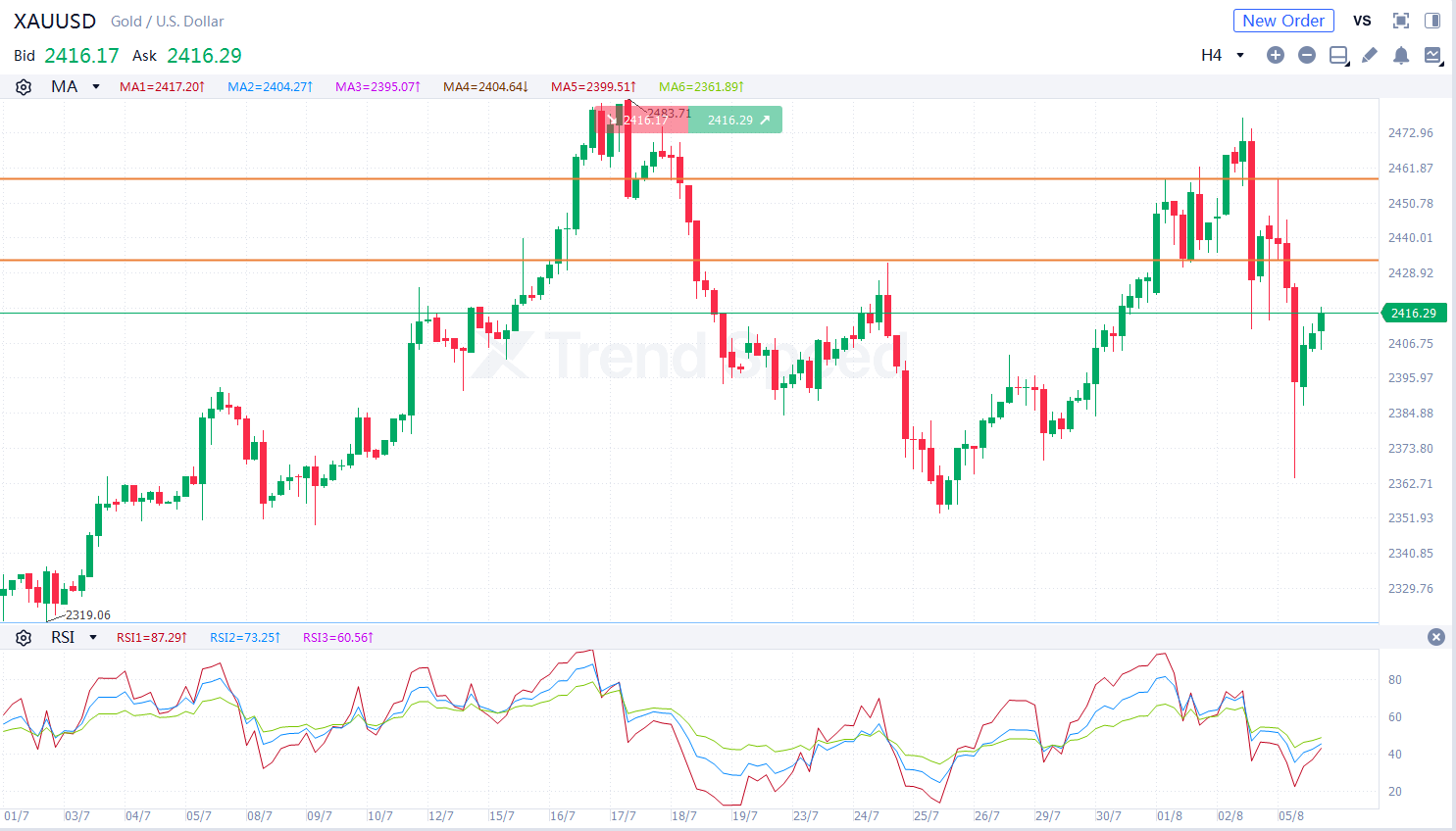

4-hour chart

On the 4-hour chart, XAUUSD was prone to fluctuation and decreased. The bearish market trend prevailed. In terms of technical indicators, RSI went downwards after death cross occurred, showing that the market trend is bearish. Investors should focus on whether XAUUSD will break through the resistance at 2432. It will fall further if it rebounds but is capped at 2432.

Key resistance: 2432, 2458

Key support: 2353, 2318

Generally speaking, XAUUSD is more likely to fall further in the short term. Investors should focus on US economic data during the day.

Hot

Technical Analysis: XAUUSD

09.12.2025

Technical Analysis: EURUSD

04.12.2025

Technical Analysis: XAGUSD

11.12.2025

Technical Analysis: XAGUSD

18.12.2025

Technical Analysis: AUDUSD

27.11.2025